Key Techniques in Bookkeeping 5089486999

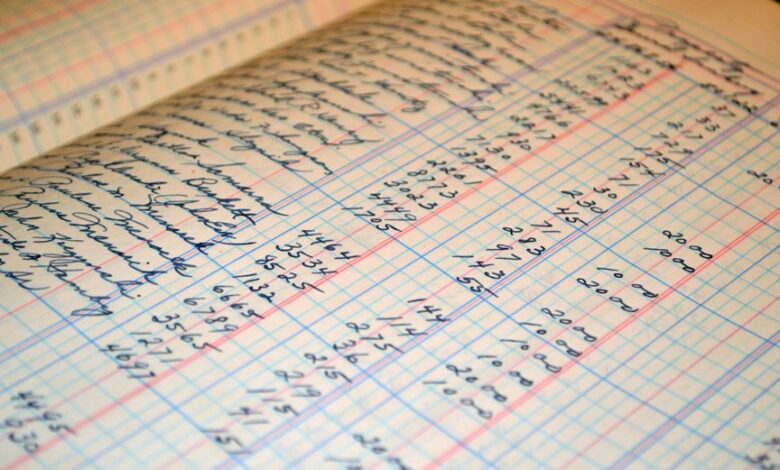

Bookkeeping is a critical function within any organization, encompassing various techniques that ensure financial accuracy and transparency. Key methods such as meticulous transaction recording, effective categorization, and regular account reconciliation play a vital role in maintaining organized financial records. Furthermore, the integration of specialized software enhances efficiency and facilitates insightful financial analysis. Understanding these techniques is essential for fostering accountability and making informed strategic decisions, yet many overlook their practical implementation.

Understanding the Basics of Bookkeeping

Bookkeeping serves as the foundational framework for financial management within any organization.

Adhering to established bookkeeping principles ensures accurate recording and categorization of financial transactions. This systematic approach not only promotes transparency but also enables stakeholders to make informed decisions.

Understanding these fundamentals empowers organizations to maintain financial integrity, ultimately fostering an environment conducive to growth and operational freedom.

Essential Bookkeeping Tools and Software

A robust bookkeeping system relies heavily on the right tools and software to enhance accuracy and efficiency.

Essential bookkeeping software includes platforms that automate data entry, streamline invoicing, and generate financial reports.

Additionally, effective accounting tools facilitate real-time collaboration and data analysis, empowering businesses to maintain comprehensive financial oversight.

Selecting suitable software is crucial for achieving financial clarity and operational freedom.

Best Practices for Accurate Record-Keeping

Maintaining accurate record-keeping is essential for businesses striving for financial integrity and accountability.

Best practices include effective record organization, which facilitates quick access to information. Additionally, transaction categorization ensures that every financial activity is appropriately classified, enabling clearer insights into financial health.

Analyzing Financial Data for Better Decision-Making

Effective record-keeping lays the groundwork for in-depth financial analysis, which is vital for informed decision-making.

By employing financial ratios, stakeholders can evaluate company performance and profitability.

Furthermore, trend analysis facilitates the identification of patterns over time, enabling proactive adjustments.

Together, these techniques empower organizations to make strategic choices that enhance operational efficiency and financial health, ultimately fostering greater autonomy and growth.

Conclusion

In summary, effective bookkeeping serves as the backbone of financial integrity, juxtaposing the chaos of disorganized records with the clarity of systematic practices. As organizations leverage advanced tools and adhere to best practices, they transition from uncertainty to informed decision-making. This transformation not only enhances operational efficiency but also fosters a culture of accountability and transparency. Ultimately, the meticulous application of bookkeeping techniques empowers businesses to navigate complexities and seize growth opportunities with confidence.