Achieving Financial Clarity With Bookkeeping 4844522185

Achieving financial clarity through effective bookkeeping is a critical aspect for organizations striving for growth. Accurate financial records not only streamline processes but also minimize errors. This reliability enables informed decision-making and enhances stakeholder trust. However, many entities overlook common pitfalls in bookkeeping, which can lead to costly consequences. Understanding these nuances is essential for organizations aiming to optimize their financial health and ensure compliance. What strategies can be employed to avoid these mistakes?

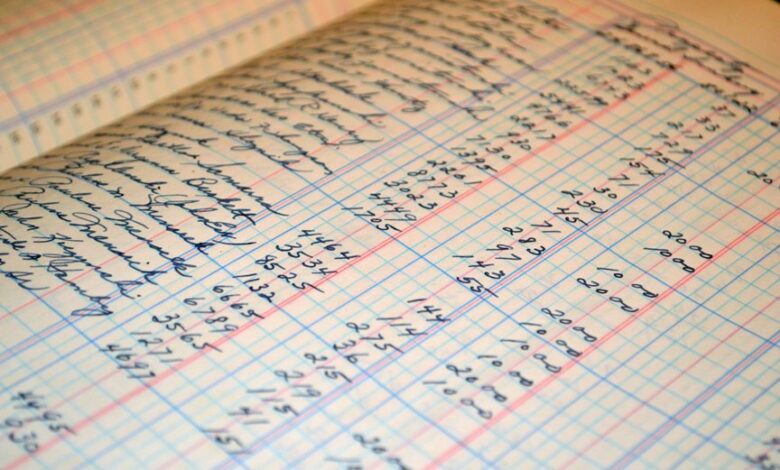

The Importance of Accurate Bookkeeping

Although many businesses may underestimate its significance, accurate bookkeeping serves as the cornerstone of sound financial management.

Financial accuracy, achieved through meticulous record-keeping, enables organizations to make informed decisions. The bookkeeping benefits extend beyond compliance, fostering operational efficiency and strategic planning.

Streamlining Financial Processes

As businesses strive for greater efficiency, streamlining financial processes becomes essential to maintaining a competitive edge.

Automating tasks such as invoicing and expense tracking not only reduces errors but also frees up valuable resources.

Additionally, optimizing workflows enhances collaboration and accelerates decision-making.

Making Informed Financial Decisions

Effective financial processes not only enhance operational efficiency but also serve as a foundation for making informed financial decisions.

Through thorough budget analysis and meticulous expense tracking, businesses can identify trends, allocate resources wisely, and prioritize investments.

This clarity empowers decision-makers to navigate financial landscapes confidently, fostering a sense of freedom in strategic planning and ensuring sustainable growth without compromising financial integrity.

Common Bookkeeping Mistakes to Avoid

Bookkeeping serves as the backbone of a business’s financial health, yet numerous pitfalls can undermine its effectiveness.

Common mistakes include misclassifying expenses, which can lead to inaccurate financial reporting and tax complications.

Additionally, neglecting reconciliations disrupts the accuracy of financial records, obscuring a company’s true financial position.

Avoiding these errors is crucial for maintaining clarity and ensuring informed decision-making within the business.

Conclusion

In the realm of financial management, accurate bookkeeping stands as a towering fortress, safeguarding organizations against the chaos of disarray and misinformation. By streamlining processes and illuminating the path to informed decision-making, businesses can navigate the turbulent waters of fiscal uncertainty with unparalleled confidence. Avoiding common pitfalls in bookkeeping acts as an unwavering shield, empowering entities to not only survive but thrive, ensuring their financial future is as bright as the sun in a clear blue sky.